A Comprehensive Guide to Global Payroll Processing

According to the EY worldwide Payroll Survey Report, 35% of businesses lack a formalized payroll strategy, with 28% having "very low" worldwide standardization for payroll operations.

Payroll operations were more efficient in organizations that had developed and outlined payroll strategies than in those that did not.

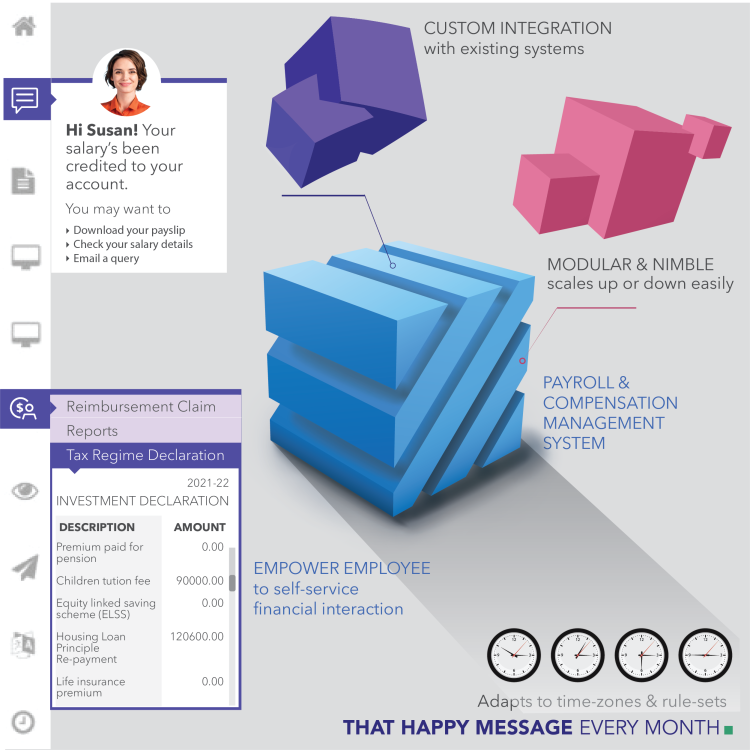

Modern businesses can streamline their operations by switching from manual, back-and-forth data transfers to a centralized, cloud based global payroll solution that is integrated with an equally sophisticated HRIS. Payroll and HR teams may collaborate more effectively, with aligned workflows and significantly decreased processing times on both sides.

Creating and documenting an organization-wide formal payroll strategy is critical for reducing risk, increasing compliance, and building an effective operating model.

Challenges associated with managing global payroll

Running a global payroll has multiple and varied issues associated with it. It is so critical and complex that even experienced HR and payroll teams struggle to manage global payroll operations.

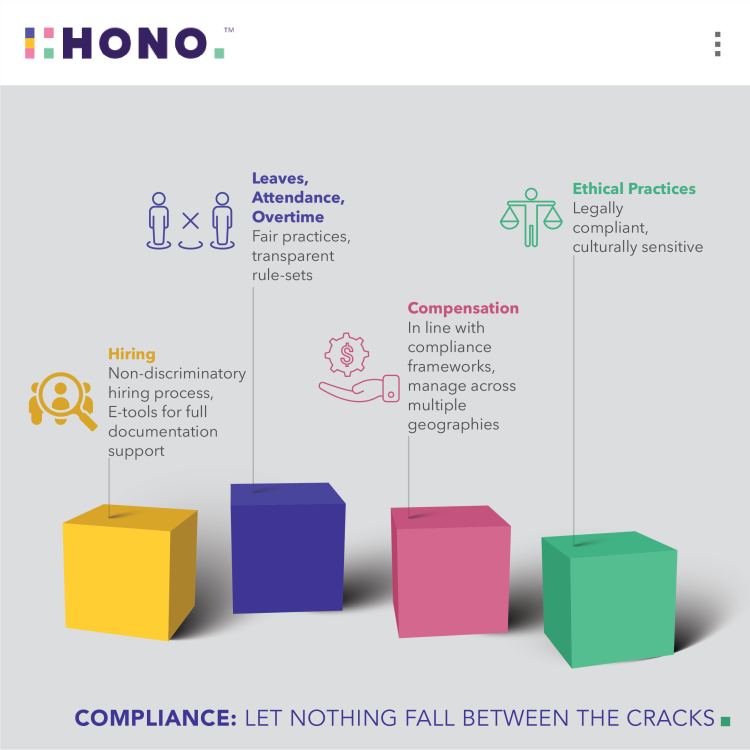

#Payroll compliance

Payroll compliance is always a challenging task for businesses, but with a global payroll involved, the difficulty level rises with each additional geography.

Every country has its own deadlines for filing reports and paying taxes, making it difficult to ensure that everything is completed on time.

Furthermore, payroll taxes and rates differ by jurisdiction, especially the laws for tax deductions and benefit management.

#Multiple vendor management

Working with multiple payroll vendors necessitates dealing with an array of different processes and systems, which is both complicated and inefficient.

Global payroll software enables interaction with the payroll systems used by many suppliers, allowing organizations to access payroll data and insights from several systems from a single centralized platform.

#Manual data handling

According to the Deloitte Global Payroll Benchmarking Survey, manual data entry is the most time-consuming part of payroll processing for 30% of organizations. The situation becomes worse when data from various payroll sources must be manually fed into the central HCM and accounting systems.

This not only means losing valuable time on tedious administrative procedures, but it also leaves more chances for error. This global payroll problem can also be solved through payroll consolidation via a centralized platform.

#Different currencies and cross-border payments

Paying employees in different currencies is another worldwide payroll difficulty mentioned by the GPMI report.

Businesses must make sure they have sufficient funds in foreign currency and enough time for payments to be handled in order to pay their global team. Also, fees for transactions and currency conversions can be high. This is one of the significant challenges faced while handling global payroll.

Related: Key Features & Benefits of an Effective Payroll System

What are the benefits of implementing global payroll software?

#Centralized control over global processes

Managing payroll is never easy, but when you have to do it for multiple countries at once, the difficulties increase. It also becomes challenging to keep tabs on everything happening everywhere.

By centralizing all payroll procedures and data in a single location, a global payroll solution streamlines global HR management without requiring additional hardware, software, or network infrastructure.

#Reduced compliance risk

Keeping up with the ever-changing legal landscape across all regions is a difficult task due to the fact that rules and regulations are not standardized from one country to the next. The challenges of managing many vendors can be addressed by connecting all ICPs on a single global payroll platform.

#Easy cross-border payments

Another significant challenge for global corporations is ensuring that everyone is paid on time and in the correct currency. International payments are costly and time-consuming, and pricing is frequently ambiguous. Organizations that make payments to various nations all over the world on a daily basis must consequently find a cost-effective and efficient solution.

Global payroll providers, such as HONO, include global payment capabilities, allowing organizations to save time and money when paying global teams.

# High-quality payroll data

It is nearly difficult for business leaders to gain access to trustworthy payroll data for their whole global workforce without global payroll services that standardize data for all geographies and then consolidate it in one central platform.

Access to consolidated, real-time payroll data is essential for gaining detailed insights that may be used to make informed business choices.

Answering some of the key queries around global payroll solutions.

How does global payroll integration with other HR systems enhance efficiency and accuracy?

If you have offices in 12 different countries, each with its own HR and payroll system, the monetary benefit of integrating the systems grows by a factor of twelve. Businesses frequently outsource payroll to local or regional payroll providers to relieve their internal staff of the compliance and processing burden.

Unfortunately, this leads to an increase in complexity because data streams, systems, and procedures are neither standardized nor consolidated.

This problem can be corrected with a global payroll solution such as HONO, which allows you to integrate all of your payroll systems - both your own and those of your global payroll providers - into a single centralized platform.

Also Read: Benefits of Integrating HR & Payroll Software

What are the potential cost savings and return on investment (ROI) associated with implementing a global payroll system?

When you consider how much time businesses lose each week on inefficient manual data entry, it's clear how important it is to eliminate data inconsistencies.

So, when you centralize global payroll with a single provider and then combine it into your Human Capital Management system, you not only reduce processing costs by getting rid of the redundancies that come with a distributed network, but you also save money.

Also, by moving payroll from manual systems to a central provider in your cloud-based HCM, you get rid of the need for IT support across the network.

How can a global payroll system handle multiple currencies, languages, and country-specific payroll requirements?

No matter how many countries you choose to include in your company's multi-country payroll process, a global payroll partner can help make sure your company follows local labor laws, minimum wage, employee benefits, payroll management, and much more.

With HONO's all-in-one payroll system, you can add people from all over the world to a single, unified team. The HONO team can take care of a lot of the administrative work for you, including hiring, onboarding, payroll, compliance, and much more.

What are the best practices for managing data privacy and security in global payroll processes?

You have to deal with a lot of information about employees when you do payroll. Since payment information is very confidential, businesses must make sure to keep it safe.

#Regular updates

Payroll software usually has a number of security features built-in. However, if systems aren't updated regularly, they quickly become out of date, leaving organizations vulnerable to new security risks and cyberattacks. To keep payroll info safe, it's important to check for updates often.

#Additional security measures

In addition to basic security measures such as firewalls and strong passwords, if your organization want to take the security of the payroll software to the next level should look into the following:

- ISO 27001 certification for IT risk management in an organization &

- Data encryption: For security purposes, it is recommended that all payroll-related documents and data be encrypted before being stored on servers.

#Limiting Access

Most of the time, the real risks come from inside the organization.

The fewer people who can access the salary system and data, the less likely it is that data will be stolen or changed. Only a small number of people in the organization should be able to use the payroll system. Those who can use it should be the most important stakeholders and people who work in the payroll department.

How can a global payroll system streamline processes and improve overall payroll efficiency?

If your company has a different payroll provider for each country where it does business, or if you just want to grow your business quickly and easily while staying in compliance across borders, you might want to think about streamlining your payroll process.

Working with a single payroll service will make it easier to handle the paperwork that comes with running a global payroll. It will also make sure that your business follows the rules and laws of each country in which it operates.

Should you consider a global payroll system right now?

It's difficult to envision a multinational corporation that wouldn't profit from a unified, strategic global payroll system. However, there are other considerations to consider before embarking on a payroll transformation.

The first step in figuring out if your organization is ready for centralized global payroll is to take stock of your current system. Start by figuring out how much it costs, including the often-hidden costs of payroll, and where your current solution doesn't meet your needs. While it is simple to list the benefits of enhanced payroll, it is critical to analyze them in the context of your organization and set particular operational and strategic goals for a new solution.

Paying your global employees should not be an obstacle to global hiring. It's hard to figure out the best way to accept payments or how to deal with different currencies and bank fees on your own.

That's why services like HONO can provide significant help.

HONO makes it easy to:

- Pay employees in their local currencies using their preferred payment options.

- Access additional local payout options to make the international payroll process easier.

Spencer's Retail Achieves Error-Free Payroll with HONO

Spencer's, India's first omnichannel food and grocery retail brand trusts HONO to meet its HCM needs. Prior to implementing HONO's Multi-Country Payroll System, Spencer's was struggling with a manual payroll process that was prone to errors. The system was also not compliant with local regulations in all of the countries where Spencer's operates. This led to costly mistakes and a poor employee experience.

Read More: Payroll Automation - How Spencer’s HR did it!

After implementing HONO's system, Spencer's has achieved error-free payroll. The system has helped them to automate their payroll process, improve compliance, and reduce costs.

HONO's Multi-Country Payroll System is a cloud-based solution that can be used to manage payroll for businesses of all sizes. The system is compliant with local regulations in over 100 countries, and it can be easily customized to meet the specific needs of each business.

Read what Spencer’s CHRO had to say about HONO’s Payroll System-

“It's like a factory that you keep running and not really dependent on annual maintenance. Earlier, people would come and settle their bills in three months, or four months - now in the system, you do it in seven days. So I think these are things which have helped us, you know, to streamline and make it much more productive,” says

Sutanu Chowdhury, CHRO, Spencer’s Retail.

Schedule a demo today to learn more about how HONO's Payroll management system can help you achieve error-free payroll.

Author:

HONO Desk

SUBSCRIBE NEWSLETTER

For HR innovation updates

Download free HR Case Studies